Offshore Vs OnShore Bonds

Many will view the concept of offshore investing with mixed feelings. Some will think that investing offshore has glamorous connotations, while others will view this sort of investing with scepticism and a whiff of tax evasion.

The structure of a bond

Onshore and offshore bonds are single premium, non-qualifying whole of life assurance contracts. This means that they are effectively investments dressed up as insurance contracts; this can bring some useful tax advantages to the investor.

Why use a bond as an investment vehicle?

The principal attractions of using a bond as an investment vehicle are as follows:

-

Bonds are not deemed to be ‘income producing assets’; this negates the need for individuals or trustees to complete self-assessment tax returns.

-

Funds within the bond can be switched without the requirement for any tax reporting and without rise to Capital Gains Tax.

-

Reinvested income in the bond does not give rise to income tax.

-

Bonds can be ‘assigned’, unlike ISAs or pensions.

-

5% can be withdrawn from the bond without immediate tax liability for 20 years cumulatively.

-

5% withdrawals are not treated as income, rather as return of capital.

‘Top slice relief’ can be used when chargeable gains cross the threshold into higher rate tax.

Bonds can be taken out with multiple lives, not true with ISAs or pensions.

Bonds can be placed in trust and taken out of a trust without rise to an Income Tax charge or CGT.

Choosing a bond

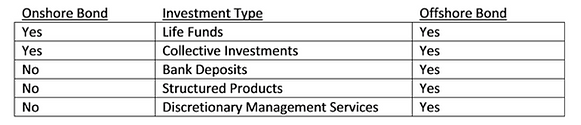

As with any tax structure it is vital to choose the underlying investments with extreme care. An offshore bond will provide far greater investment opportunities than its onshore counterpart:

It should be kept in mind that this greater flexibility will come with higher charges. The provider will levy dealing charges to buy and sell different investments in the bond; there will also be custodian charges and provider specific charges to be mindful of. There needs to be a sound case that justifies paying much higher fees for greater investment flexibility.

Consumer protection

Different jurisdictions Offshore bonds, as their name implies, are outside the UK for tax purposes. This means that they do not come under the UK’s consumer protection rules. It is key when looking at the consumer protection offered by the jurisdiction where the offshore bond sits e.g. Isle of Man, Dublin, or Guernsey. Only when you understand and are comfortable with that protection should you consider using a provider that favours one jurisdiction over another.

Comparative Tax Treatment & Management expenses.

The fact that the income generated by offshore bonds rolls up without being taxed is very attractive, however the individual withholding tax also needs to be taken into consideration. Both types of bond will have management expenses to pay, an onshore fund has some tax to pay therefore these expenses can be offset; conversely an offshore bond has no tax to offset these expenses. Planning opportunities Offshore Bonds provide the investor with the ability to defer and plan taxation. As financial planners, we use these structures facilitate fairly complex tax planning for our clients. Being able to hold asserts offshore and pay no tax on the capital increases or income distributions until a point in time specified by us, to fit around other controllable sources of income, is an invaluable tool.

If you would like to arrange an initial meeting with us at your convenience and at our cost to discuss how we may be able to help please contact us.